All Categories

Featured

Table of Contents

That commonly makes them an extra affordable option for life insurance coverage. Numerous individuals get life insurance policy coverage to assist economically protect their enjoyed ones in instance of their unforeseen death.

Or you might have the option to convert your existing term coverage into an irreversible policy that lasts the rest of your life. Various life insurance policies have possible advantages and drawbacks, so it's vital to comprehend each before you choose to acquire a policy.

As long as you pay the costs, your recipients will receive the survivor benefit if you die while covered. That stated, it's crucial to note that many policies are contestable for two years which suggests protection can be retracted on fatality, needs to a misrepresentation be found in the app. Policies that are not contestable usually have a graded fatality advantage.

What You Should Know About Level Benefit Term Life Insurance

Premiums are usually lower than entire life policies. You're not locked into an agreement for the rest of your life.

And you can not pay out your plan throughout its term, so you won't receive any monetary take advantage of your previous insurance coverage. Just like other sorts of life insurance policy, the expense of a level term plan depends upon your age, protection requirements, work, lifestyle and health and wellness. Generally, you'll find more inexpensive coverage if you're younger, healthier and much less dangerous to guarantee.

Since degree term costs stay the very same for the duration of coverage, you'll know exactly just how much you'll pay each time. Level term protection additionally has some versatility, permitting you to customize your plan with extra functions.

What Does Level Term Life Insurance Meaning Mean for You?

You might need to satisfy specific conditions and certifications for your insurance provider to enact this cyclist. In addition, there might be a waiting duration of as much as 6 months before taking impact. There likewise can be an age or time limitation on the coverage. You can include a kid motorcyclist to your life insurance policy plan so it also covers your kids.

The survivor benefit is commonly smaller, and coverage generally lasts up until your youngster transforms 18 or 25. This motorcyclist might be a more economical method to assist guarantee your youngsters are covered as motorcyclists can often cover multiple dependents at once. Once your kid ages out of this protection, it might be possible to convert the cyclist right into a brand-new plan.

The most common type of permanent life insurance policy is entire life insurance, however it has some key differences contrasted to degree term insurance coverage. Below's a basic summary of what to consider when contrasting term vs.

How Does What Is Level Term Life Insurance Help You?

Whole life entire lasts insurance coverage life, while term coverage lasts for a specific periodCertain The costs for term life insurance coverage are normally reduced than entire life coverage.

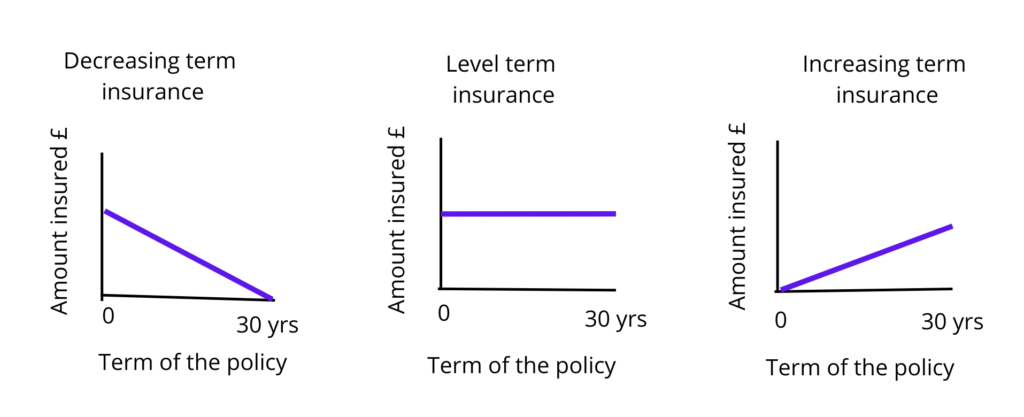

One of the highlights of degree term protection is that your premiums and your survivor benefit don't transform. With decreasing term life insurance policy, your premiums stay the exact same; however, the survivor benefit quantity obtains smaller sized in time. As an example, you might have coverage that starts with a death advantage of $10,000, which can cover a mortgage, and after that annually, the survivor benefit will certainly reduce by a collection amount or portion.

Due to this, it's frequently an extra budget-friendly type of degree term coverage., yet it might not be enough life insurance for your demands.

The Meaning of Life Insurance

After choosing on a policy, finish the application. For the underwriting procedure, you might need to supply general individual, wellness, lifestyle and employment information. Your insurance company will determine if you are insurable and the threat you might provide to them, which is mirrored in your premium prices. If you're authorized, authorize the documentation and pay your first costs.

You may want to update your beneficiary info if you have actually had any kind of substantial life modifications, such as a marriage, birth or separation. Life insurance can often feel complex.

No, degree term life insurance coverage does not have cash value. Some life insurance plans have an investment attribute that enables you to build money worth gradually. A section of your costs repayments is established apart and can earn passion in time, which expands tax-deferred throughout the life of your insurance coverage.

You have some options if you still want some life insurance coverage. You can: If you're 65 and your coverage has run out, for example, you might desire to purchase a brand-new 10-year degree term life insurance policy.

What is 30-year Level Term Life Insurance? Your Essential Questions Answered?

You may have the ability to transform your term insurance coverage right into a whole life policy that will certainly last for the rest of your life. Lots of kinds of degree term policies are exchangeable. That suggests, at the end of your coverage, you can convert some or all of your plan to whole life protection.

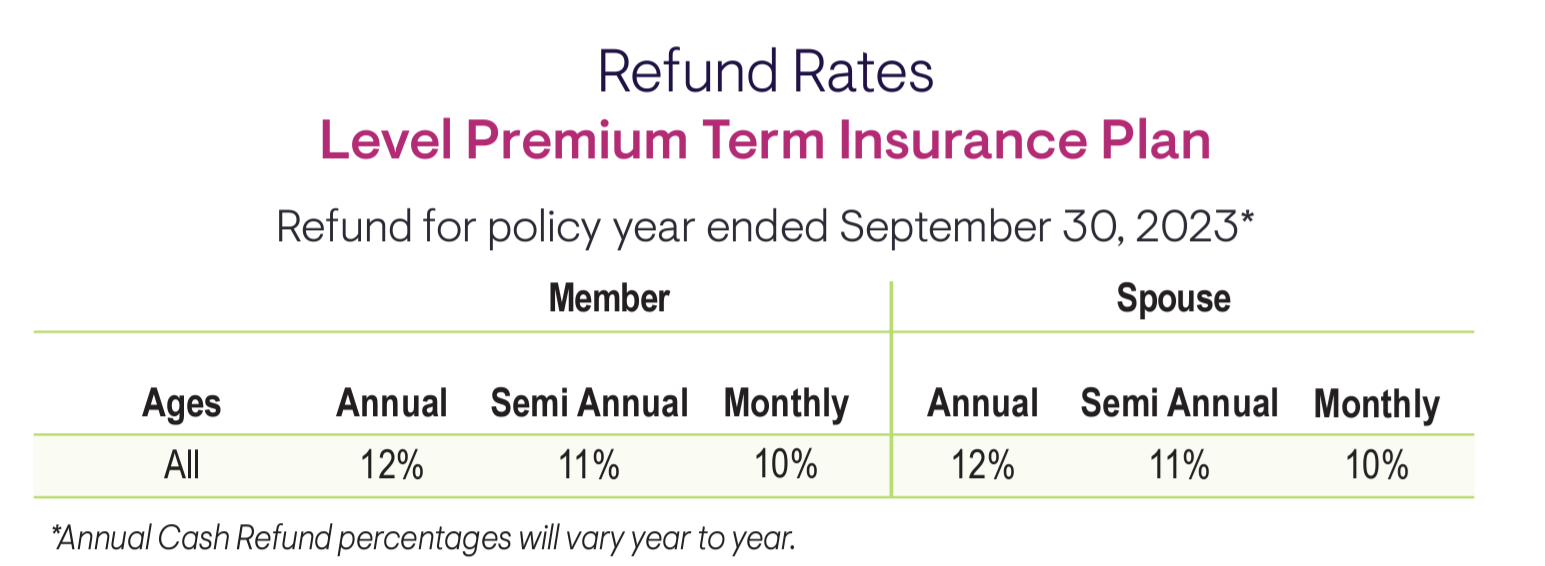

A degree premium term life insurance coverage strategy lets you stick to your budget while you help shield your household. Unlike some tipped price plans that enhances each year with your age, this kind of term strategy offers prices that stay the very same for the period you select, even as you grow older or your health and wellness adjustments.

Find out more about the Life Insurance policy choices readily available to you as an AICPA member (10-year level term life insurance). ___ Aon Insurance Coverage Providers is the brand name for the broker agent and program management operations of Fondness Insurance Solutions, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Policy Firm, Inc. (CA 0795465); in OK, AIS Fondness Insurance Services Inc.; in CA, Aon Affinity Insurance Coverage Solutions, Inc .

Latest Posts

Instant Life Insurance Quotes Online

Funeral Expense Insurance For Seniors

End Of Life Expenses