All Categories

Featured

Table of Contents

Life insurance policy offers 5 monetary benefits for you and your family. The main benefit of including life insurance policy to your monetary strategy is that if you pass away, your heirs receive a lump sum, tax-free payout from the plan. They can utilize this money to pay your final expenditures and to change your revenue.

Some plans pay if you create a chronic/terminal ailment and some offer financial savings you can utilize to sustain your retired life. In this short article, learn more about the numerous advantages of life insurance and why it may be a great concept to spend in it. Life insurance policy provides benefits while you're still to life and when you die.

Who has the best customer service for Estate Planning?

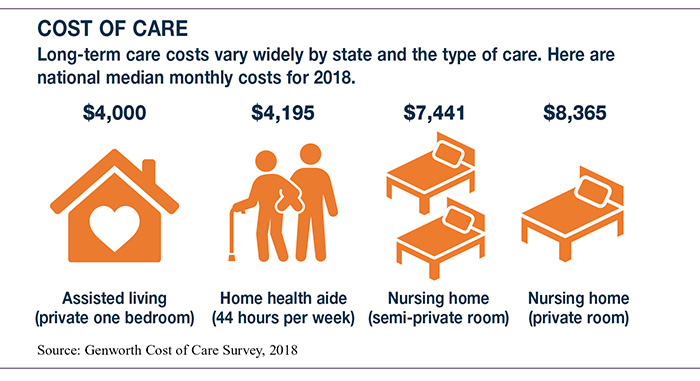

Life insurance payments typically are income-tax complimentary. Some irreversible life insurance policy policies develop cash worth, which is cash you can secure while still alive. Life insurance policy can also pay if you establish a major ailment or go right into an assisted living home. The nationwide mean expense of a funeral service that includes a funeral and a burial was $7,848 as of 2021.

If you have a policy (or policies) of that dimension, the individuals that depend on your earnings will still have cash to cover their continuous living expenses. Beneficiaries can utilize plan advantages to cover vital everyday expenses like rental fee or home loan payments, energy costs, and groceries. Average yearly expenditures for houses in 2022 were $72,967, according to the Bureau of Labor Data.

Life insurance policy payouts aren't taken into consideration revenue for tax objectives, and your recipients don't have to report the money when they submit their tax obligation returns. A recipient might obtain made rate of interest if they pick an installment payout choice. Any type of interest obtained is taxable and have to be reported - Final expense. Depending on your state's regulations, life insurance policy benefits may be used to balance out some or all of owed inheritance tax.

Development is not affected by market conditions, allowing the funds to accumulate at a secure rate with time. Furthermore, the cash money value of entire life insurance policy grows tax-deferred. This means there are no earnings taxes accrued on the cash money value (or its development) till it is withdrawn. As the cash worth develops over time, you can use it to cover costs, such as getting a car or making a deposit on a home.

Who offers Level Term Life Insurance?

If you make a decision to obtain against your cash money value, the loan is exempt to earnings tax obligation as long as the plan is not surrendered. The insurance policy company, nonetheless, will certainly bill passion on the financing amount until you pay it back. Insurer have varying rate of interest on these loans.

8 out of 10 Millennials overstated the expense of life insurance in a 2022 research study. In truth, the typical cost is closer to $200 a year. If you assume buying life insurance policy might be a smart economic step for you and your household, think about seeking advice from a financial expert to embrace it right into your economic plan.

How long does Legacy Planning coverage last?

The five primary kinds of life insurance are term life, whole life, universal life, variable life, and final cost insurance coverage, likewise known as funeral insurance. Entire life starts out setting you back extra, yet can last your entire life if you keep paying the premiums.

Life insurance policy might likewise cover your home mortgage and give money for your household to keep paying their expenses. If you have family members depending on your revenue, you likely need life insurance policy to support them after you pass away.

appeared January 1, 2023 and offers ensured acceptance entire life coverage of approximately $40,000 to Professionals with service-connected disabilities. Learn a lot more concerning VALife. Lesser amounts are readily available in increments of $10,000. Under this strategy, the chosen insurance coverage takes impact 2 years after enrollment as long as costs are paid throughout the two-year duration.

Insurance coverage can be extended for as much as two years if the Servicemember is completely disabled at splitting up. SGLI coverage is automated for most energetic obligation Servicemembers, Ready Reserve and National Guard members scheduled to carry out at the very least 12 periods of non-active training annually, members of the Commissioned Corps of the National Oceanic and Atmospheric Administration and the Public Health and wellness Solution, cadets and midshipmen of the U.S.

Who has the best customer service for Living Benefits?

VMLI is available to Veterans who obtained a Particularly Adjusted Housing Give (SAH), have title to the home, and have a mortgage on the home. near brand-new enrollment after December 31, 2022. Nonetheless, we began approving applications for VALife on January 1, 2023. SGLI protection is automated. All Servicemembers with full time insurance coverage need to make use of the SGLI Online Registration System (SOES) to designate beneficiaries, or decrease, decline or bring back SGLI insurance coverage.

All Servicemembers should utilize SOES to decline, decrease, or bring back FSGLI protection.

What should I know before getting Retirement Planning?

Plan advantages are decreased by any kind of superior loan or financing rate of interest and/or withdrawals. Rewards, if any, are influenced by plan lendings and loan passion. Withdrawals above the price basis might lead to taxable ordinary revenue. If the policy gaps, or is given up, any type of exceptional financings taken into consideration gain in the plan might go through normal earnings tax obligations.

If the policy proprietor is under 59, any taxed withdrawal may likewise be subject to a 10% federal tax charge. All entire life insurance policy assurances are subject to the prompt repayment of all needed premiums and the cases paying capacity of the releasing insurance coverage firm.

The cash surrender value, loan value and death profits payable will certainly be decreased by any kind of lien outstanding due to the settlement of a sped up advantage under this cyclist. The accelerated benefits in the initial year show deduction of an one-time $250 management fee, indexed at a rising cost of living price of 3% per year to the rate of velocity.

A Waiver of Premium cyclist waives the responsibility for the policyholder to pay more costs ought to he or she become entirely handicapped continuously for at the very least 6 months. This motorcyclist will certainly incur an added expense. See plan agreement for extra details and needs.

Why do I need Protection Plans?

Discover a lot more about when to get life insurance. A 10-year term life insurance policy policy from eFinancial prices $2025 monthly for a healthy and balanced adult who's 2040 years old. * Term life insurance policy is more budget-friendly than permanent life insurance policy, and female customers usually get a lower rate than male clients of the same age and wellness standing.

Latest Posts

Instant Life Insurance Quotes Online

Funeral Expense Insurance For Seniors

End Of Life Expenses