All Categories

Featured

Table of Contents

When life stops, the bereaved have no option yet to maintain relocating. Virtually right away, households have to handle the complicated logistics of death adhering to the loss of an enjoyed one.

Furthermore, a complete survivor benefit is typically offered unintentional fatality. A customized death advantage returns costs typically at 10% interest if fatality happens in the initial two years and includes the most unwinded underwriting. The full survivor benefit is typically provided for unexpected fatality. Most sales are carried out in person, and the sector fad is to accept an electronic or voice signature, with point-of-sale choices accumulated and videotaped through a laptop or tablet.

To finance this service, companies depend on personal wellness meetings or third-party data such as prescription backgrounds, fraud checks, or automobile documents. Underwriting tele-interviews and prescription backgrounds can frequently be utilized to aid the agent finish the application procedure. Historically business rely upon telephone interviews to validate or verify disclosure, however more lately to improve client experience, companies are relying upon the third-party information indicated over and giving instant decisions at the factor of sale without the interview.

Selling Final Expense Life Insurance

What is last cost insurance coverage, and is it always the best course forward? Below, we take a look at just how final expense insurance policy works and elements to consider before you acquire it.

While it is described as a policy to cover final expenditures, beneficiaries who get the fatality benefit are not called for to utilize it to pay for last expenditures they can use it for any type of purpose they like. That's because last cost insurance policy really falls under the group of changed entire life insurance policy or simplified issue life insurance policy, which are commonly whole life policies with smaller fatality advantages, usually between $2,000 and $20,000.

Our opinions are our own. Burial insurance is a life insurance plan that covers end-of-life expenditures.

Using Life Insurance To Pay For Funeral

Burial insurance needs no medical examination, making it accessible to those with clinical conditions. This is where having interment insurance, additionally recognized as final expenditure insurance coverage, comes in handy.

Nonetheless, simplified problem life insurance policy requires a health assessment. If your wellness condition disqualifies you from traditional life insurance policy, funeral insurance might be an option. In enhancement to less health and wellness examination needs, funeral insurance policy has a quick turnaround time for approvals. You can get insurance coverage within days and even the very same day you apply.

, interment insurance policy comes in a number of types. This policy is best for those with light to moderate health problems, like high blood stress, diabetes mellitus, or asthma. If you do not desire a clinical test yet can qualify for a simplified issue policy, it is normally a better bargain than an ensured concern policy due to the fact that you can get more coverage for a less expensive costs.

Pre-need insurance policy is dangerous due to the fact that the recipient is the funeral home and coverage is details to the chosen funeral home. Ought to the funeral chapel fail or you vacate state, you may not have coverage, which beats the objective of pre-planning. Additionally, according to the AARP, the Funeral Service Consumers Partnership (FCA) recommends versus buying pre-need.

Those are essentially funeral insurance policy plans. For ensured life insurance, premium estimations depend on your age, gender, where you live, and protection quantity.

Interment insurance uses a streamlined application for end-of-life insurance coverage. Most insurance coverage companies need you to talk to an insurance policy agent to apply for a plan and acquire a quote.

The goal of having life insurance is to relieve the concern on your enjoyed ones after your loss. If you have an extra funeral plan, your loved ones can utilize the funeral plan to take care of final expenditures and get an immediate dispensation from your life insurance policy to manage the home mortgage and education prices.

Individuals who are middle-aged or older with medical conditions may think about burial insurance, as they might not get traditional policies with stricter approval standards. Furthermore, interment insurance policy can be valuable to those without extensive cost savings or typical life insurance policy coverage. Funeral insurance policy varies from various other sorts of insurance coverage because it provides a lower death advantage, typically only sufficient to cover expenditures for a funeral and various other linked expenses.

Funeral Trust Insurance Companies

News & World Report. ExperienceAlani has actually examined life insurance policy and family pet insurance policy firms and has actually created various explainers on travel insurance, credit rating, financial debt, and home insurance coverage. She is enthusiastic regarding debunking the intricacies of insurance policy and various other personal money topics to make sure that viewers have the details they need to make the finest money choices.

The even more protection you obtain, the greater your costs will be. Last expenditure life insurance policy has a variety of advantages. Namely, everybody that uses can obtain authorized, which is not the case with other kinds of life insurance coverage. Final expense insurance policy is often suggested for seniors who might not receive traditional life insurance coverage due to their age.

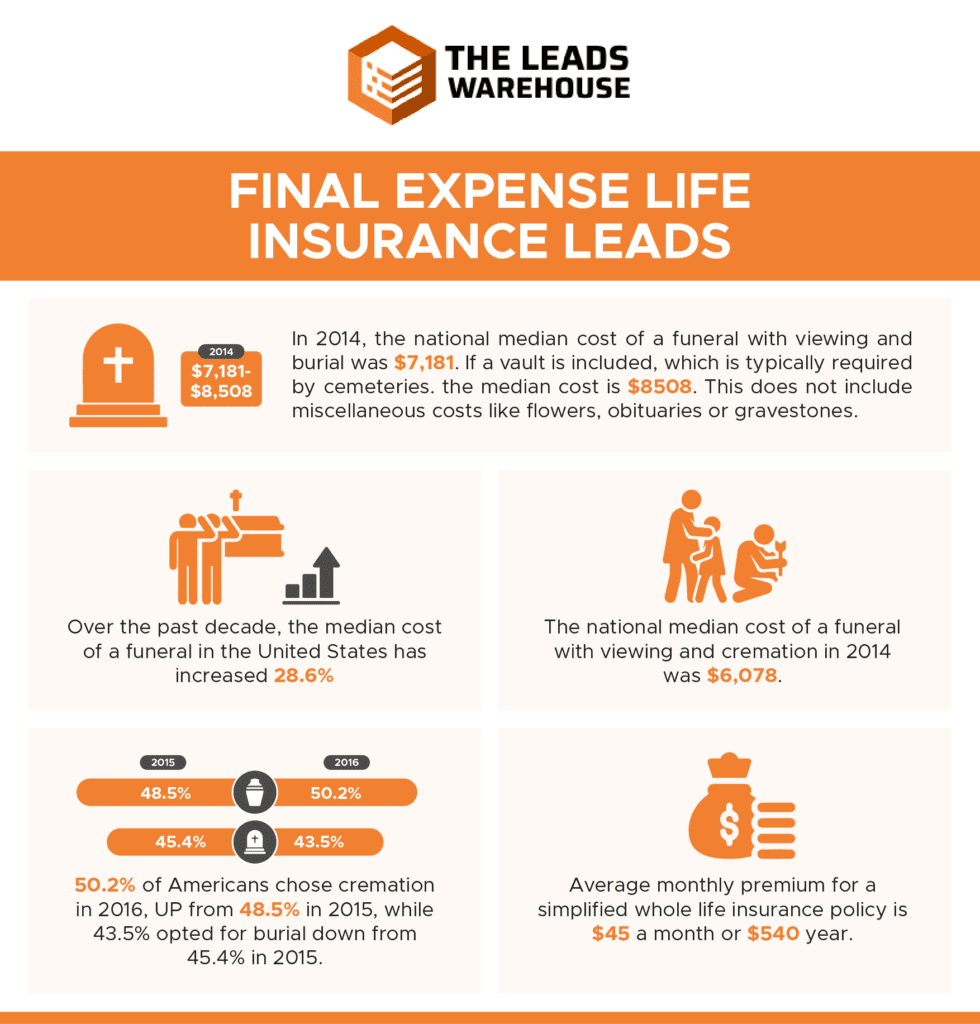

In addition, final cost insurance coverage is helpful for people that wish to spend for their very own funeral. Burial and cremation services can be costly, so last expenditure insurance policy provides tranquility of mind knowing that your enjoyed ones will not need to use their cost savings to pay for your end-of-life plans. However, last expenditure insurance coverage is not the most effective product for everybody.

Funeral Insurance For Over 50s

You can examine out Principles' guide to insurance coverage at various ages if you need help determining what type of life insurance coverage is best for your phase in life. Obtaining entire life insurance policy via Values fasts and very easy. Coverage is offered for senior citizens between the ages of 66-85, and there's no clinical test needed.

Based upon your feedbacks, you'll see your approximated price and the quantity of protection you receive (between $1,000-$30,000). You can acquire a plan online, and your insurance coverage begins immediately after paying the first premium. Your rate never ever transforms, and you are covered for your entire lifetime, if you proceed making the month-to-month repayments.

Eventually, we all have to assume about how we'll pay for an enjoyed one's, or perhaps our very own, end-of-life costs. When you sell final expense insurance, you can supply your clients with the comfort that features understanding they and their families are gotten ready for the future. You can also get a possibility to maximize your book of service and develop a new revenue stream! Ready to learn whatever you need to understand to begin offering last expenditure insurance coverage effectively? Nobody suches as to assume regarding their very own death, however the fact of the matter is funeral services and interments aren't affordable.

Furthermore, clients for this type of strategy could have serious legal or criminal backgrounds. It's crucial to note that various carriers offer a variety of issue ages on their guaranteed concern plans as reduced as age 40 or as high as age 80. Some will also use higher face values, approximately $40,000, and others will enable better death benefit conditions by boosting the interest rate with the return of premium or minimizing the variety of years up until a complete death benefit is readily available.

Latest Posts

Instant Life Insurance Quotes Online

Funeral Expense Insurance For Seniors

End Of Life Expenses